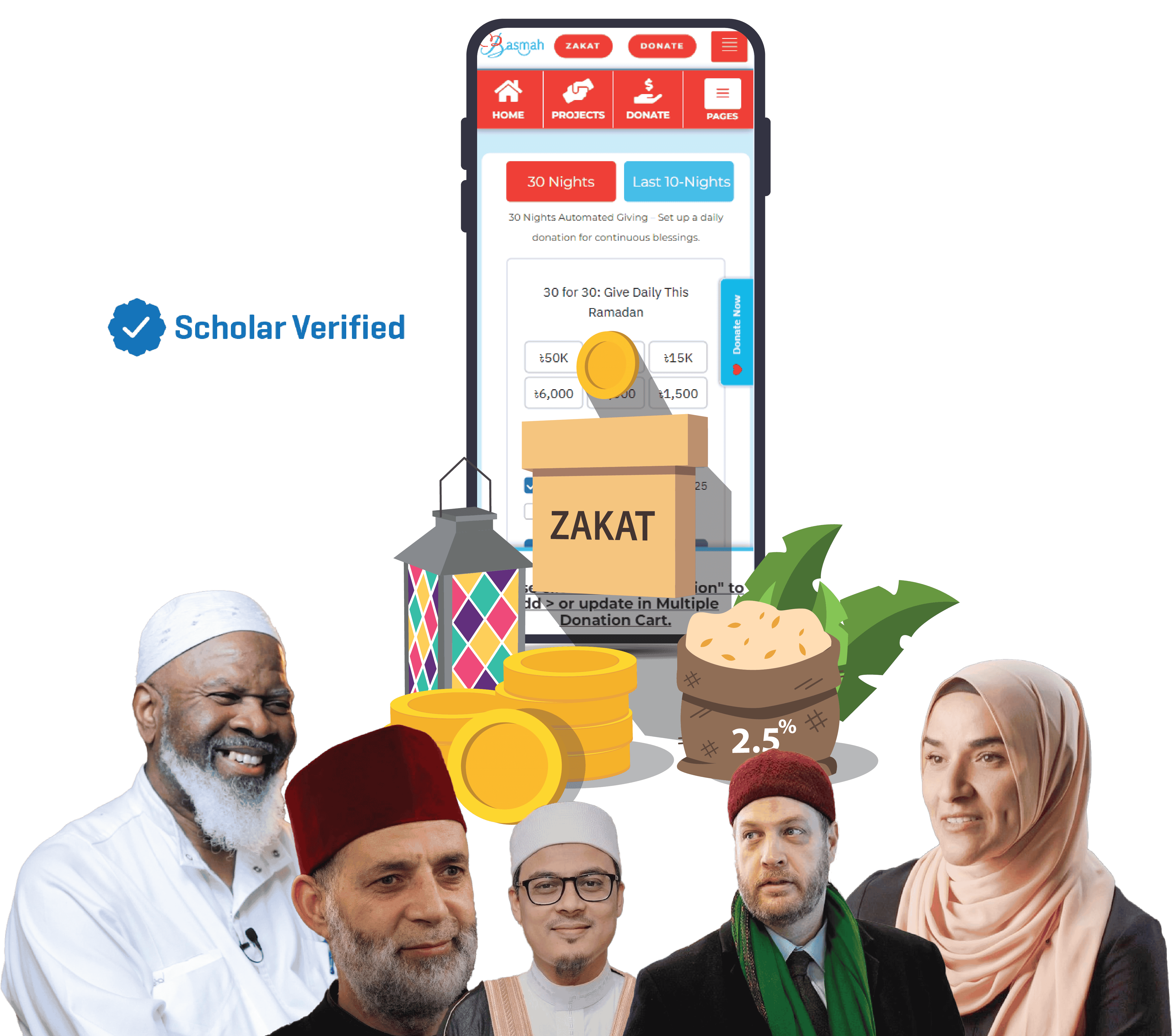

Basmah Zakat Calculator:

Calculate Your Zakat with Confidence

Accurately determine your Zakat with our scholar-verified calculator, ensuring your contribution is precise and impactful.

Our Zakat Calculator simplifies the process, guiding you step by step to determine your exact Zakat obligation. Backed by Islamic scholars, it ensures compliance with Islamic principles, helping you purify your wealth and support those in need with confidence.

ZAKAH CALCULATOR

Calculate Your Zakat Easily

Use our Zakat calculator to easily determine your Zakat amount and make a meaningful contribution towards the betterment of society.

Deductions

Totals

Trusted by those you trust

"I'm on the advisory board of this great organization, Basmah. And I'm saying to you, from a man on the inside, they do a lot of incredible work. I'm amazed every day by more and more work; they don't stop, they never stop."

"One of the premier organizations that is helping and concentrating on the Rohingya crisis is Basmah. Basmah has been working for the last few years and working on the ground in the refugee camps. It has been providing assistance to thousands of refugees every single day."

"Support the amazing work that Basmah is doing and ensure that you are a part of this, so that we can, inshaallah, be a reason for people's hope in this world."

In the sea of great causes to support, I want to highlight the incredible work of Basmah. This grassroots organization is making a significant impact, especially in aiding the Rohingya in Bangladesh. Let's not forget those in need, and Basmah is playing a crucial role in ensuring they receive help. Consider adding Basmah to your giving list for its fantastic humanitarian efforts.

Basmah is truly doing remarkable work, particularly in the Rohingya refugee camp in Bangladesh. I extend my gratitude to all who have generously donated to this organization. May Allah abundantly reward your contributions. I encourage everyone to support Basmah in their amazing efforts.

Basmah's commitment to helping Rohingya refugees in Bangladesh is truly inspiring. A heartfelt thank you to all those who've supported this vital cause. May your generosity resonate far and wide, and may Allah reward your kindness abundantly. Let's continue standing with Basmah in their noble efforts.

In the realm of grassroots efforts, Basmah stands out, particularly in their work with Rohingya refugees. A sincere thank you to the contributors who've fueled this impactful initiative. May Allah magnify the impact of your kindness, and may your support continue to be a source of comfort for those in need. Let's persist in championing Basmah's compassionate mission.

Zakat Guideline

The literal meaning of the Arabic word ‘zakat’ is “increase,” as in “growth.” It also suggests “betterment” and “blessings,” as well as “purification” and “sweetening.” Early in its 23-year period of gradual revelation, the Quran, Islam’s scripture, gave the Arabic word ‘zakat’ its current meaning for Islam’s prescribed almsgiving.

Islam obliges its followers who have the financial means, to pay a yearly, compulsory payment for those who are deserving of this charity. This levy notably does not come as a burden to its payers. The Prophet, on him be peace, as a part of Revelation specified the kinds of wealth out of which Zakat payments come directly due, their minimum amounts, and their rates of one-time-yearly payment.

Islam not only considers Zakat as a simple good deed, though Allah immeasurably rewards it, but as an essential sacred rite – on par with the Pillar of worship with which Allah in the Quran most often pairs it; the five-times daily Salah-Prayer, which notably defines Muslim devotion and punctuates the believer’s day.

Individual Muslims are required by faith to learn Zakat’s rules and fulfil them correctly. This means assessing Zakat accurately on one’s various wealth streams and carrying out its proper distribution at its due times to its specified beneficiaries.

Zakat has three main conditions set by the Prophet, on him be peace, as part of Revelation:

NISAB (threshold at which zakat becomes due). This marks the minimum quantity of a particular material good or wealth type a person owns – becoming “wealthy” in it by measures Islam sets – from which one must pay Zakat. ‘Nisab’ in Arabic literally means ‘origin,’ because the right of the poor in one’s wealth-kind begins at this point of its accumulation. (See Nisab and Zakat Calculation in a Nutshell and What Is Nisab in Islam?)

PAYMENT RATE. Each type of eligible wealth has a Zakat percentage. A 2.5% rate is assessed on all surplus personal and business wealth. Agricultural produce has a 5% or 10% Zakat rate, depending on natural watering or irrigation of crops. Livestock is gauged at itemized in-kind rates. Treasure troves (hidden windfalls and extraction of natural resources) one pays at 20%. (See How Is Zakat Calculated on Weatlh?)

YEARLY PAYMENT (Hawl). Each type of eligible wealth has a due date of payment. Surplus, personal and business wealth and livestock come due exactly one lunar Islamic year (hawl) after its initial nisab is reached or upon their established Zakat Due Date (ZDD). The Zakat of agricultural produce and treasure troves (hidden windfalls and extraction of natural resources) come due at time of harvest – and this is also the analogous ruling applied by many modern scholars for high wage and salary earners, to pay Zakat on its nisab-level increments upon receipt.

While a Muslim must pay due Zakat to remain in the fold of Islam, its payment provides its givers with both worldly and spiritual blessings.

It is a means of “purifying” the believer’s soul from sin and training it out of its inclination to greed. As a sanctified worldly financial transaction, it cleanses one’s wealth from its inherent material taint, keeping it, as it were, “sweet.” Zakat left mingled with one’s wealth, the Prophet, on him be peace, warns us, causes it to spoil and physically diminish. For Allah has made the temporal property He truly owns but gives us, in its reality, a spiritual commodity.

Zakat directly alleviates the poor and needy of worldly hardship, improving their life conditions while upholding their human dignity.

That is why Allah has established Zakat — not as a voluntary charity given to whomever at the discretion and goodwill of one’s wealthier fellows — but as the due right of His divinely designated recipients. Allah is the broker of the wealth He has invested with us. Zakat is the dividend of its surplus owed annually to His select beneficiaries at set due dates in specified amounts when His investments reach stipulated benchmarks.

Zakat is not intended to serve as a stopgap measure of short-term or one-time relief. It is meant to institutionalize and anchor a communal enterprise that systematically eliminates poverty and servitude on earth.

Zakat functions as the primary socio-financial institution of the global Muslim community. It aims at annually recalibrating the just human balance in society, fostering harmony between relatives and neighbours, and strengthening shared unity and equitable social cohesion.

Zakat also gives a divinely deliberate incentive for the Muslim well-to-do to invest and not hoard their wealth, as hoarding is the major direct cause of poverty in humanity and wealth circulation through reinvestment spending raises all boats in the economic sea.

Yes. All interest-bearing transactions (called ‘riba’ in the Quran) are the forbidden opposite of the obligatory Zakat-alms transaction. (See What Is Riba and Why Is It Forbidden in Islam? and What Types of Riba Are There?)

Allah specifically contrasts the divine losses that accrue to those who give riba (interest-bearing) loans to “gain” from people with the much-multiplied blessing He gives to those who pay the obligatory Zakat to the poor and needful for His sake alone.

Yet beware, for whatever you give others in interest – to gain increase from the wealth of people – shall never increase with Allah! But blessed is whatever you give of the Zakat-Charity – desiring only the Face of God. For it is such as these who shall have a much-multiplied reward.” (Surat Al-Rum, 30:39)

Your Zakat can change lives. Utilize your Zakat money to help remove the suffering of hundreds of thousands of underprivileged people in Bangladesh, who do not have enough food, clothes, and other essentials required to live a normal life.

BASMAH provides direct assistance to Rohingya refugees in Bangladesh. Five orphanages in Bangladesh were made possible by its running Zakat. Of them, one is located outside the Rohingya camp and the other four are located inside the camp. Within the Rohingya camps, we also run a medical clinic with zakat capabilities.

Give your Zakat to help the Rohingya Refugees. They are one of the most deserving people as they have no land, no country, no identity, and no place to go back. Your Zakat can be the source for the basic needs of food, medicine, and clothes of the Rohingya refugees, who are currently living in overcrowded, filthy conditions.

You can also donate your Zakat to orphans and helpless children to ensure a future full of opportunities and love.

Your Zakat donation has incredible power, Give Zakat to BASMAH to save lives & serve humanity.

The Prophet PBUH said: “Give charity without delay, for it stands in the way of calamity.” – Al-Tirmidhi